The crisis caused by the Russian military offensive against Ukraine turned the life of numerous people upside down roughly a year ago. Alongside the unprecedented humanitarian crisis, European regional supply chains and IT off, - and nearshoring common practices have also been wildly disrupted since then, because Eastern Europe and especially Ukraine are the biggest tech hubs for this workforce.

Our market report looks at the current state of the software development nearshoring market in Europe and helps to summarize the current possibilities for those about to hire tech professionals.

Current challenges of the IT workforce

The IT industry is a rapidly expanding market due to the increasing dependence of modern society on technology. To ensure the availability and accessibility of vital governmental and industrial systems, there is a high demand for well-trained human resources. Over the last few years, the number of qualified IT workers has risen, and the demand for IT professionals is predicted to increase by more than 10% in the following years alongside the predicted information technology market worth of $11995.97 billion[1] by 2027.

Discussing the need for more tech employees while a potential recession looms and tech layoffs are projected across the industry may seem illogical. Thousands of IT professionals throughout the globe lost their employment in January, causing many concerns at the start of the year.

“The Western European and overseas companies lay off several tech personnel, mainly for correcting the previous overhiring mistakes and trying to rationalize the year’s budget. These steps or the hiring of less costly workforce can ease the current pressure a bit, but companies seek sustainable solutions on the long run, too. This process emphasizes a quality-based demand, from a reshuffling talent pool. “ states Péter Borzák, CEO of INSPYRE Informatics.

Finding the proper talent won't get any simpler or less crucial as a result, though. Employers will still need to make wise staffing choices, in which offshoring provides considerable alternatives.

IT export from the war-affected areas

Since the outburst of the war, Ukraine or Russia has suffered from the loss of 70 000, or more young men so far, refugees have left their countries from both sides, seeking peace and opportunities in the West or overseas. By now, more than 8 million Ukrainians left their homeland as refugees.

When Ukraine was attacked, IT outsourcing providers and purchasers' top priorities were guaranteeing the security of their partners and staff in the area and limiting service disruption via relocation aid packages and remote employment.

After 24 February 2022, Belarus’ IT professionals, just like many Russians after the declaration, emigrated to neighbouring countries or moved to a foreign company, where their employment is not threatened by an imposed sanction on their homeland.

We witness that the Ukrainian IT outsourcing services market withstood the invasion and the subsequent martial law restrictions, demolition of critical infrastructure, army draft, mobilization, and massive relocation of IT company personnel in the last year.

It did not simply persevere the Russian onslaught, but the IT export in Ukraine from January to November 2022 shows the following numbers:

· IT services exports increased by 7.3%, bringing in over $6.5[2] billion,

· exceeding the 2021 figure by $447[3] million,

· however, at the same time, total service export revenue for this period decreased by 11.5% compared to 2021.

These statistics suggests that Ukraine stills holds it potential. Let’s dive deeper into the Eastern European area in terms of IT export capabilites.

Outsource – offshore – nearshore?

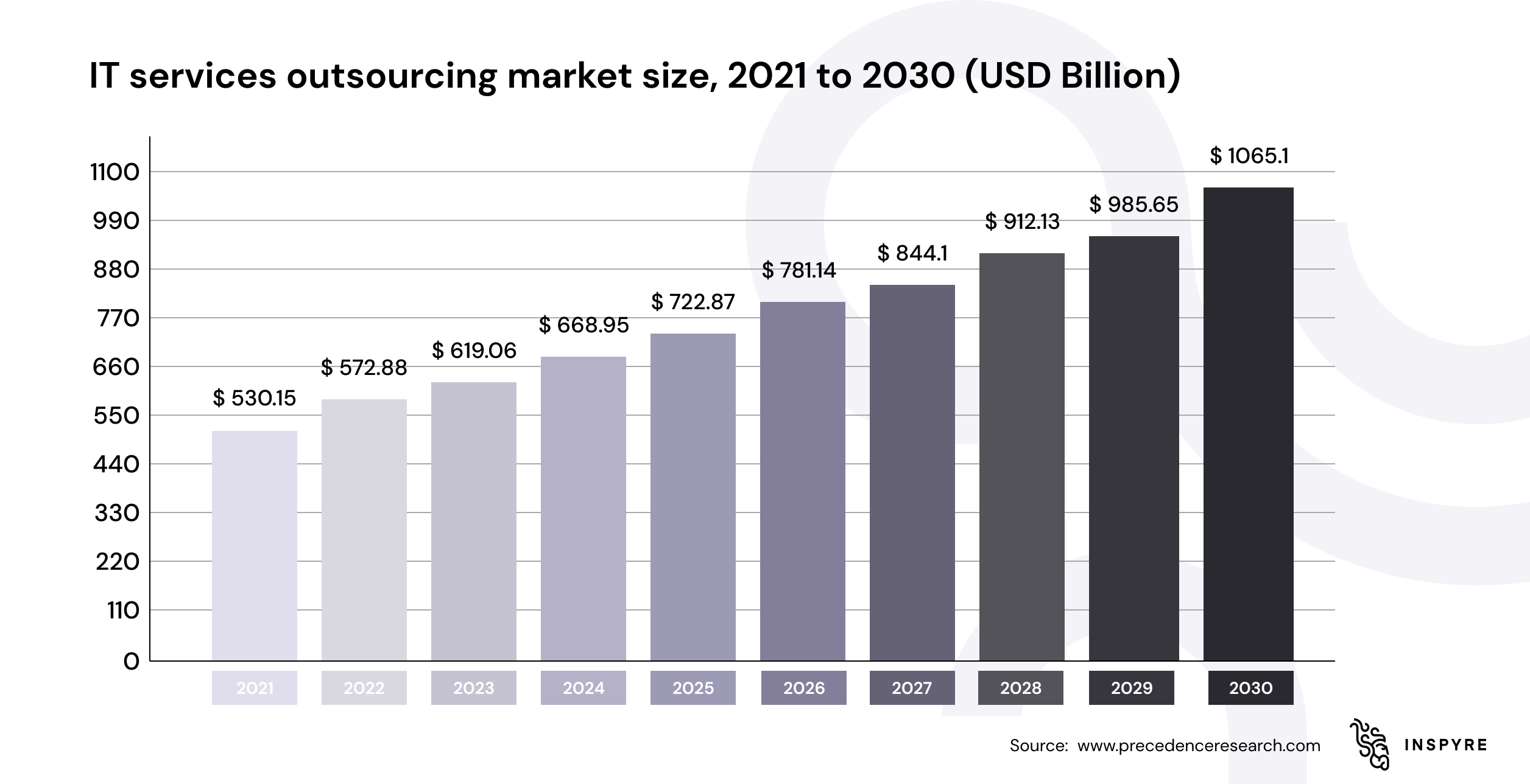

To alleviate the IT workforce shortage and easing the financial pressure, outsourcing in-country to a specialized staff or hiring people from abroad (offshoring) for a more moderate price, have both shown to be effective solutions for businesses. This market has been continuously increasing and offers companies access to a larger pool of competent candidates and other advantages.

Hiring foreign personnel from a nearby nation is a significant step. Despite the growing number of remotely accessible locations, companies should be aware of the cost-benefit ratio when choosing a country for offshoring, as well as infrastructure, trade, and business climate, which are also crucial factors.

Since businesses have resorted to offshoring portions of their IT operations, they have realized that cultural and geographic distance plays a significant role in the success of IT offshoring initiatives. As a result, businesses started to offshore to nations with a geographic and cultural closeness alongside a big supply of qualified IT personnel, and competitive labor rates.

This process of specialized offshoring was given the moniker nearshoring which is widely used now as a preferred type of offshoring.

Eastern European possibilities

A study since then has empirically demonstrated that most European corporations now have not just a considerable amount of nearshored employees, but also associated firms near their headquarters.

In Europe, Western European tech firms typically employ an Eastern workforce because of the outstanding advantages of Eastern European nearshoring:

· These countries’ GDPs and cost of living are significantly lower than the Western ones, so these countries’ professionals’ wages generally tend to be lower.

· They can provide a well-educated, proficient English-speaker workforce.

· Sometimes, they offer tax incentives for companies investing in their territory, such as Poland.

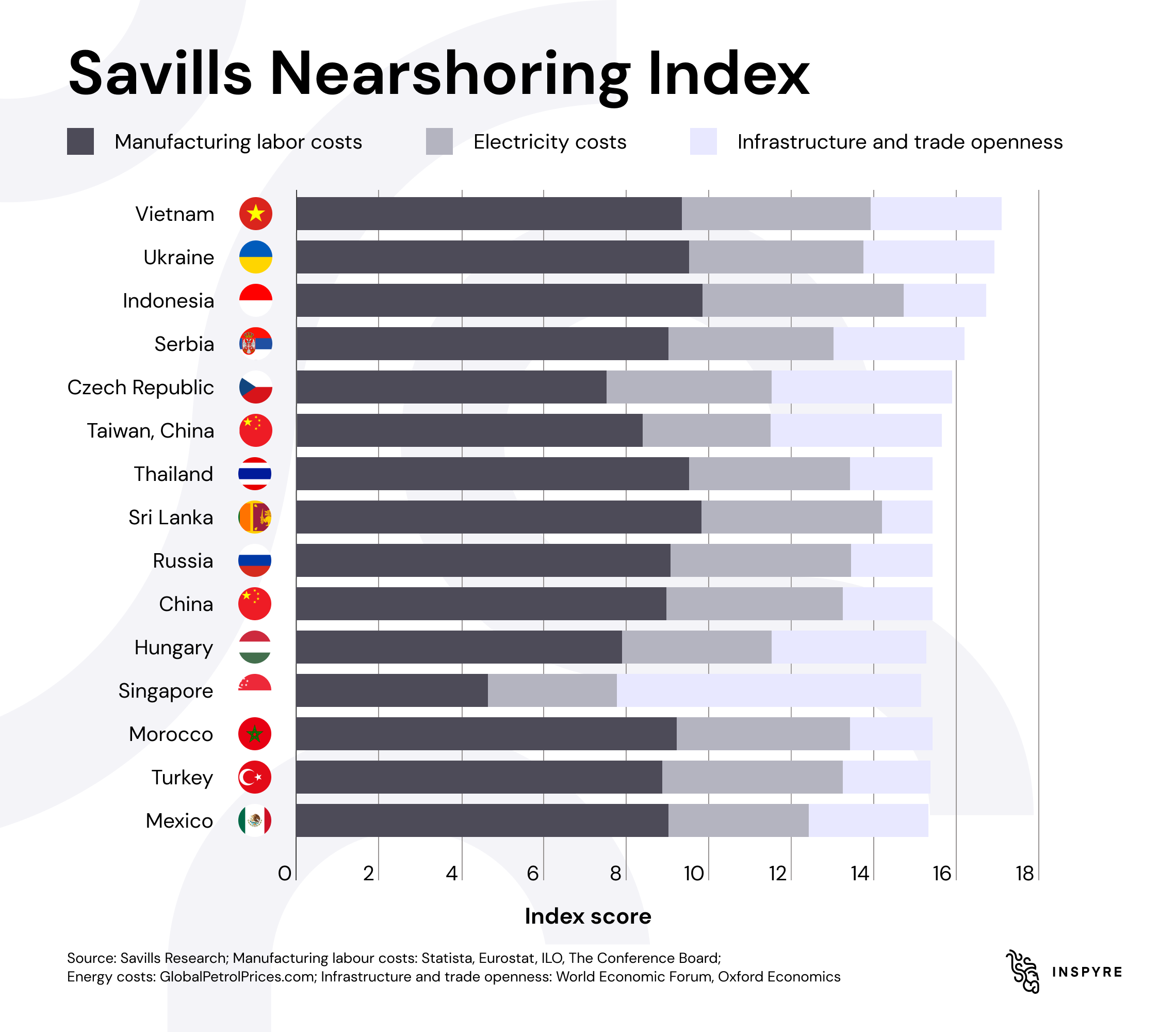

The Savills Nearshoring Index identifies nations with the highest potential for nearshoring: in 2020, Vietnam, Ukraine, and Indonesia were on the leaderboard, followed by Serbia, the Czech Republic and Hungary as potential Eastern European tech hubs for nearshoring.

Other sources stress the possibility in Belarus and Romania as well.

Practices in European software development nearshoring

“The customers of nearshoring reacted to the consequences of this unforeseen conflict in two different ways:

· They keep and try to support their nearshored developers from the involved regions but also stay open and actively search for additional possibilities in the neighbouring regions such as Poland or Hungary.

· They switched to the cheaper but in some terms less convenient offshore opportunities to the Middle East, in most cases, to India.”

says Péter Borzák, CEO of INSPYRE Informatics.

“The first one seems to be a highly beneficial structure: because of the relative proximity, the hired workforce can easily adapt to a western working atmosphere and support the ongoing processes with less training or mentoring,” Péter Borzák adds.

We need to mention here that when considering nearshoring, potential nearshoring customers should evaluate EU countries as strongly considerable locations, due to their easy geographical accessibility to other member states.

The nearshored company’s personnel don’t need special visas or documents to cross the countries’ borders whenever their client needs a short personal meetup. The same goes for the imposed EU and global sanctions: EU member states cannot be affected by these, which also ensure their positions as trustworthy nearshoring destinations.

Conclusion

In conclusion, Eastern European countries offer a good opportunity for nearshoring due to their cost-effectiveness, cultural and geographical proximity, and supportive business environment.

Here are some key insights:

· Despite the challenges posed by reshuffling hiring pools, there is still a high demand for tech professionals.

· Outsourcing, offshoring, and nearshoring possibilities are actively investigated by European and overseas companies due to talent shortages and financial considerations.

· Despite the ongoing war, Ukraine remains a strong tech hub, and the region offers a high-quality workforce at a reasonable price compared to Western countries.

· The customers of nearshoring either keep and try to support their nearshored developers from the war-involved regions but also stay open and actively search for additional possibilities, or explore alternative opportunities, such as offshore options in the Middle East, often in India.

· Nearshoring holds its value in the relative proximity of the hired personnel.

· European companies should consider EU member states for nearshoring, as they offer easy geographical accessibility without the need for visas, and they are not affected by global sanctions.

Enjoyed reading it?

If you found this article informative, consider sharing it with a colleague!

Author, editor:

Henriett Kóti

Communications Specialist

henriett.koti@inspyre.it

[1] Nearly 433 quadrillion HUF

[2] More than 2 trillion 327 billion HUF

[3] More than 171 billion HUF

(all currencies are based on March, 2023 data)